Prevent Fraudulent Activity for Online Banking on HPE NonStop

Share This!

Copy link to clipboard

Copy link to clipboard Email link

Email link Print

Print

Situation

A European bank provides online account access to its customers for a banking application that runs on HPE NonStop systems. Fraud occurs and is difficult to identify and prosecute.

The intent to commit a crime is not sufficient; the crime must actually be attempted for prosecution. Fraudulent financial activity is increasing in the region, particularly in online banking.

Problem

- This situation is costing the bank a lot of money.

- The bank has had limited success assisting authorities in prosecuting the crimes.

- The bank needs a straight-forward method to integrate the fraud-detection process without having to rewrite its applications.

Solution

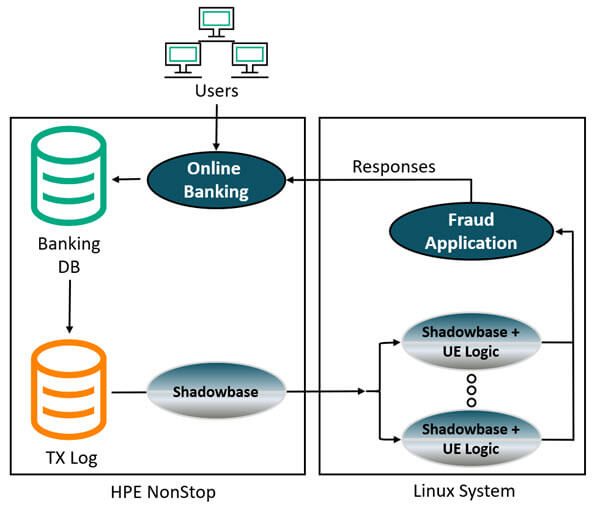

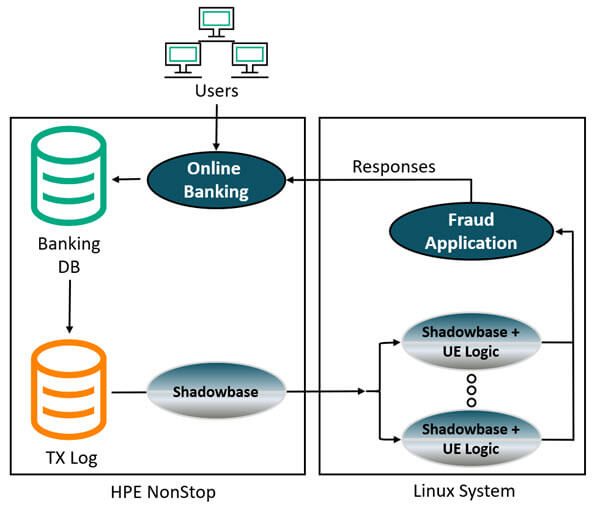

- Use HPE Shadowbase Application Integration to integrate the HPE NonStop online banking activity in real-time with a Linux-based fraud-scoring application, to detect and prevent fraud before it occurs.

- Enable the prosecution of the crime by demonstrating actual, attempted fraud.

Figure 1 — HPE Shadowbase Fraud Detection Architecture

Outcomes

- Reduced costs from fraudulent activity

- Crimes using the online application are easier to identify, prosecute, and have a higher conviction rate

HPE Shadowbase Products of Interest

- HPE NonStop Shadowbase Basic Data Integration Software (BE443AC/QSA51V6)

- HPE NonStop Shadowbase Advanced Data Integration LTU (BE444AL/QSA52V6)

- HPE NonStop Shadowbase Essential Software (BE446AC/QSA54V6)

- HPE Shadowbase Basic Application Software 1-8 core or 9+ core (WSA51V6T1/T2)

- HPE Shadowbase Basic Application Software LTU 1-8 core or 9+ core (WSA52V6T1/T2)

Contact us or your HPE Shadowbase representative, and learn how Shadowbase software will benefit you.

Further Reading

Related Case Study:  Winning the Battle Against Internet Banking Fraud by Leveraging Real-Time Data and Application Integration

Winning the Battle Against Internet Banking Fraud by Leveraging Real-Time Data and Application Integration

Related White Paper:  HPE Shadowbase Streams for Application Integration

HPE Shadowbase Streams for Application Integration

Related Solution Briefs:

![]() Winning the Battle Against Internet Banking Fraud by Leveraging Real-Time Data and Application Integration

Winning the Battle Against Internet Banking Fraud by Leveraging Real-Time Data and Application Integration![]() HPE Shadowbase Streams for Application Integration

HPE Shadowbase Streams for Application Integration