- About

- Solutions

- Essentials

- Utilities

- Publications

- Product Delivery

- Support

The largest U.S. processor of credit card transactions provides ATM and point-of-sale (POS) card management services for a variety of financial and commercial firms on HPE NonStop systems.

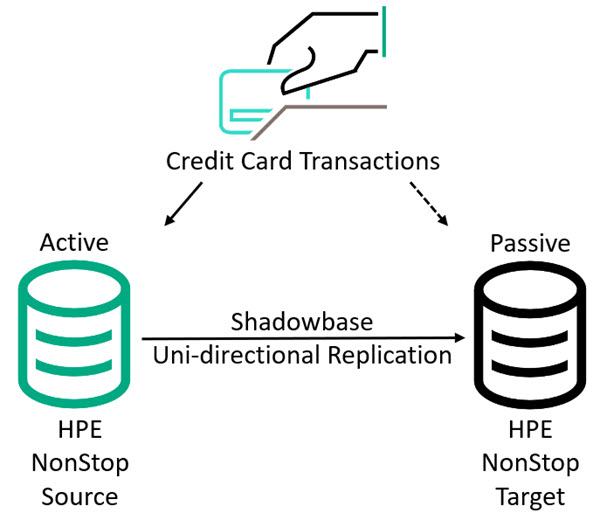

Figure 1 — HPE Shadowbase Active/Passive Disaster Recovery Architecture

Figure 1 depicts the processor’s new architecture: the CMA users update the active, HPE NonStop source server, and Shadowbase uni-directionally replicates the database changes to the passive, HPE NonStop target server. If the primary system fails, the IT team can disconnect the users from the active server, start the applications on the target node, and connect them to the passive backup server.

Contact us or your HPE Shadowbase representative, and learn how Shadowbase software will benefit you.

Related White Paper: ![]() Choosing a Business Continuity Solution to Match Your Business Availability Requirements

Choosing a Business Continuity Solution to Match Your Business Availability Requirements